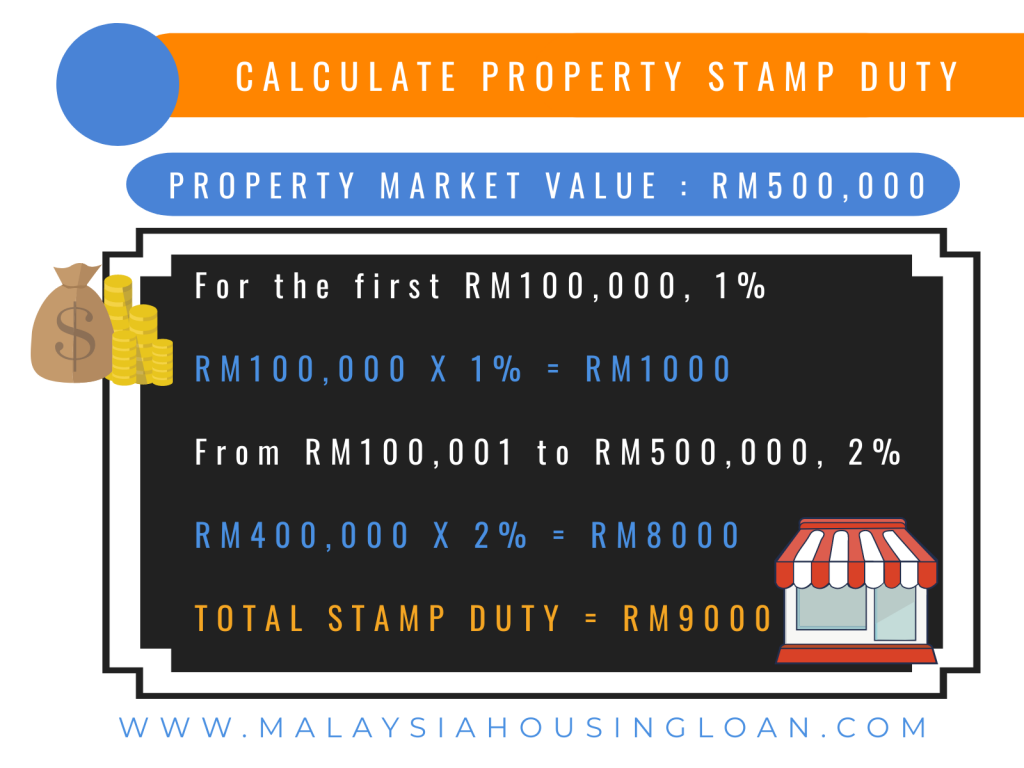

10 Order 2021 EO. On the next RM 400000 as much as RM 8000 will then be paid.

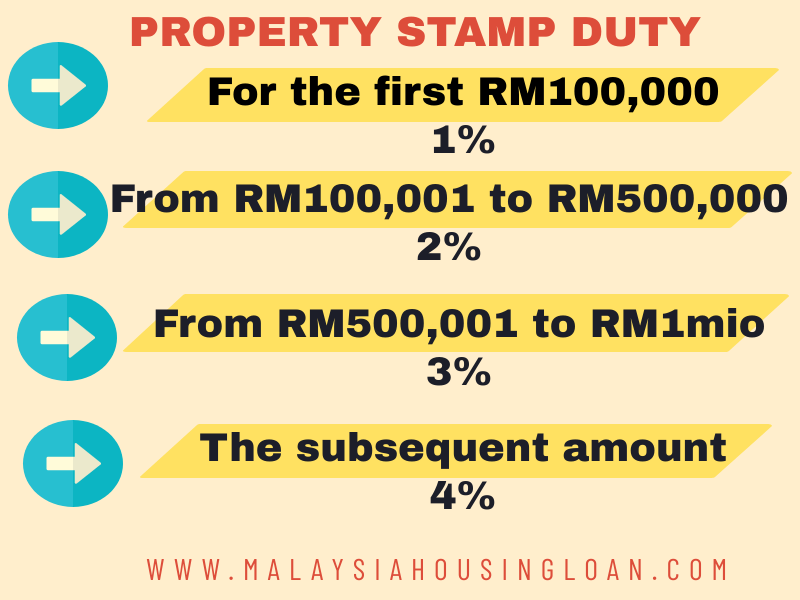

The stamp duty for the SPA is only RM10 per copy while the stamp duty for MOT and DOA is calculated according to a fee structure of 1 to 4.

. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor. 1021 was gazetted on 10 September 2021 and is deemed to have come into operation retrospectively on 1 January 2021. Of a first residential home value priced up to RM500000 by Malaysian citizens.

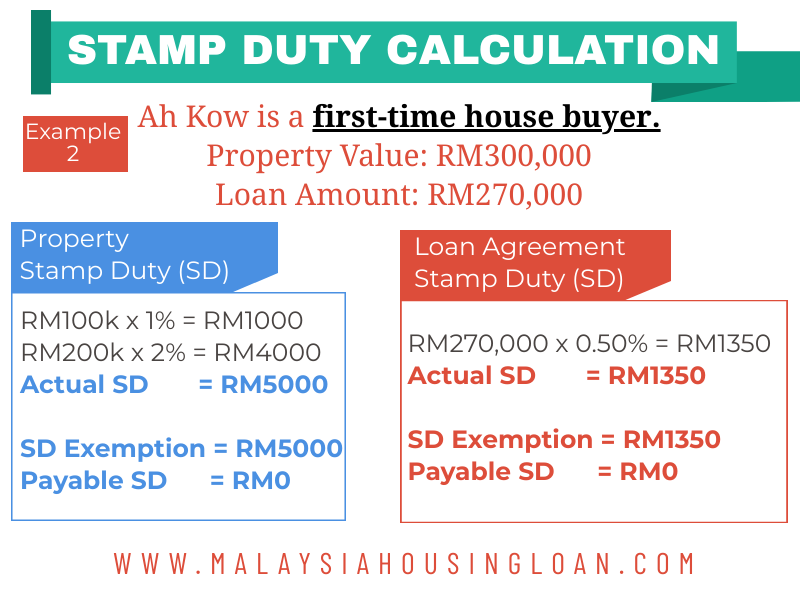

Stamp duty also applies for loan agreements but it is capped at a maximum rate of 05 of the full value of the loan. Stamp Duty Exemption Order Explanation. This exemption was confirmed in Budget 2021 put forward by the Malaysian government on 6 November 2020.

The following are the legal fees rate in. Let us look into the rates of stamp duty in Malaysia. Full stamp duty exemption will be given to both instrument of transfer and loan agreement for the purchase of a first home.

16 Order 2021 Exemption Order No. This Order comes into force on 01012021. For the first homes purchase up to RM500000 stamp duty on the transfer and loan agreement instrument is fully exempted from the propertys.

Stamp Duty Exemption Order 2021 PUA 532021as attached in relation to stamp duty exemption on instrument of transfer for purchase of residential property and Stamp Duty Exemption Order No. Announced changes to stamp duty in Malaysia mean that first-time homebuyers are now exempt from certain stamp duty charges. Stamp duty exemption on loanfinancing agreements executed from 1 January 2022 to 31 December 2026 between MSMEs and investors for funds raised on a peer-to-peer P2P platform registered and recognised by the Securities Commission Malaysia.

The exemption on the instrument of transfer is limited to the first RM1Million of the property price and the stamp duty will be charged RM3 for every RM100 of the balance. Stamp duty exemption on instruments of transfer of businesses assets or real properties acquired for instruments executed from 1 January 2013 but not later than 31 December 2017. To begin this process please key in your 12-digit NRIC No.

If you have lost your password you must set a new password. A Guide to Property Stamp Duty Exemption for Homebuyers in Malaysia. Lembaga Hasil Dalam Negeri Malaysia provides stamp duty relief based on certain cases under Section 15 Section 15A of the Stamp Act 1949 where these are.

Stamp Duty Exemption on Memorandum of Transfer. As part of the Malaysian Governments initiative to help ease the financial burden faced by small and medium enterprises affected by the economic downturn caused by the Covid-19 outbreak the Stamp Duty Exemption No. The Government will provide 100 stamp duty exemption on the instrument of transfer and loan agreement for the purchase.

An instrument is defined as any written document and in general- stamp duty is levied on legal commercial and financial instruments. Properties other than stocks or marketable securities. Budget 2022 Stamp Duty Exemption For First-Time Buyers.

16 exempts from stamp duty any insurance policy or takaful certificate for product issued by a licensed insurer or a licensed takaful operator to an individual with an annual premium or takaful contribution not exceeding RM150. To further encourage Malaysians to purchase their first home in Budget 2021 the Government proposed to waive the stamp duty on the instruments of transfer and loan agreements for the purchase of first residential homes valued up to RM500000 previously RM300000. Exemptions on Stamp Duty applicable for industrial properties There are some exemptions of stamp duty for industrial and commercial properties.

Remission of 50 stamp duty chargeable on the instrument of transfer of immovable property operating as voluntary disposition between parent and child. Stamp Duty Exemption No. 16 Order 2021 PUA 4652021 The Stamp Duty Exemption No.

There are few exemptions. During the Budget 2021 tabling Finance Minister Tengku Datuk Seri Zafrul Tengku Abdul Aziz stated that first-time buyers will be given stamp duty exemptions on the memorandum of transfer documents MOT and loan agreements. The Order provides that all instruments of transfer for the purchase of a residential property valued from RM300001 to RM25 million based on market value under the HOC 2021 will be exempted from stamp duty in respect of up to RM1 million of the market value of the residential property.

Stamp duty exemption on instrument of agreement for a loan or financing in relation to a Micro Financing. For an amount reaching RM 1 million the taxpayer should prepare RM 24000. The exemptions are applicable for sale and purchase agreements SPAs.

Stamp Duty Exemption No4 Order 2020. The exemption of stamp duty with effective on 1 June 2020 for the residential property price between RM300000 to RM25Million. On the first RM 100000 RM 1 is collected per RM 100 which totals RM 1000.

The oldest exemption that is set to expire on 31 December 2020 is a long standing exemption of stamp duty for transfer or lease for purpose of qualifying. With the start of 2021 here are eleven 11 stamp duty exemption orders that have expired in year 2020These include stamp duty exemptions that have been valid since many years ago in 2012 2013 2018 and 2019. The buyer will be entitled for a stamp duty exemption for the MOT and only need to pay a nominal fee of RM10 provided.

In the latest Stamp Duty Exemption Order 2021 PUA 53 on instrument of transfer such as Memorandum of Transfer MOT. Stamp Duty Exemption No. The Assessment and Collection of Stamp Duties is sanctioned by statutory law now described as the Stamp Act 1949.

The person liable to pay stamp duty is set out in the Third Schedule of Stamp Act 1949. Headquarters of Inland Revenue Board Of Malaysia. What are the latest stamp duty exemption orders.

The Luxe Klcc Mof Stamp Duty Exemption For Houses Priced Up To Rm1m During House Ownership Campaign 0124448516 Malaysia

Can You Guarantee To Get A Stamp Duty Exemption For First Time House Buyer Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2022 Malaysia Housing Loan

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Stamp Duty And Administration Fee 2 Important Aspects For Tenancy Agreement In Malaysia

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Malaysia Law Firm With More Than 30 Lawyers Since 2009 In Pj Kl Johor Penang Perak Negeri Sembilan

Property Insight Malaysia The 2019 Stamp Duty Exemption For First Time Home Buyers In An Effort To Reduce The Cost Of Ownership Of First Home For Malaysian Citizens The Stamp Duty

Memorandum Of Transfer Malaysia 2022 Malaysia Housing Loan

Stamp Duty Valuation And Property Management Department Portal

Seraya Residences Singapore Property Showroom Sell Property Property High Life

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Stamp Duty On A Probate Property What Exemptions Are Available Youtube

Pin By Nisarga Homes On Nisarga Homes Real Estate Home Loans Real Estate Houses Home

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2022 Malaysia Housing Loan

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Property Stamp Duty Exemption Question Malaysia Housing Loan